Property Tax Frequently Asked Questions

How does your property assessment impact your property taxes?

Some confusion surrounds property assessments and their connection to property taxes so let’s clear that up.

My BC Assessment doubled, does this mean my property taxes will too?

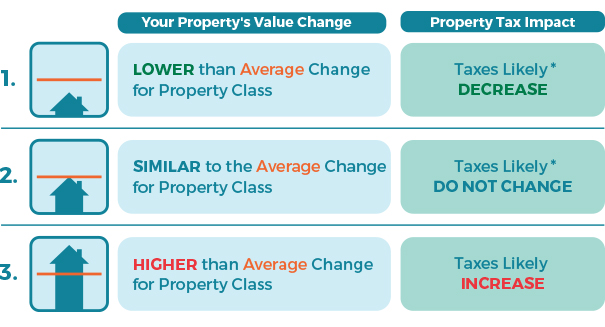

Not necessarily. If your property assessment is in line with the average assessment increase in Nanaimo, your City of Nanaimo property tax increase will equal the approximate increase approved by Council for this year. If your assessment is lower than average, your property tax increase will be lower. If your assessment is higher than average, your property tax increase will be higher.

So, it’s not how much your assessed value has change, but how it has changed compared to the average change in your property class. The image below from BC Assessment's website illustrates what was explained above.

If the assessed values are higher does that mean the City gets more money?

Funds received by the City are used to offset the cost of programs and services. The budgeting process for the City is extensive, taking many months each year. To put it simply, we calculate how much it will cost to “run” the City (deliver services, maintain infrastructure, deliver projects, contribute to infrastructure renewal reserves, etc.) in a given year and then determine how we are going to pay for that. Tax rates are then calculated to collect only the revenue required from the assessed base.

I want to appeal my BC Assessment, where do I do that?

If you have received an assessment that you don’t agree with, you can appeal it through the BC Assessment Authority. You can find contact information and more on your assessment notice and find information on appealing on the BC Assessment website. The deadline to appeal is January 31 (or later if the due date falls on a weekend).

I have my BC Assessment figures, why can’t the City tell me what my tax bill is going to be for the year?

Although the City of Nanaimo has determined what the approximate property tax increase may be, there could be changes to the approved Financial Plan before the tax rate bylaws are set, which happens each year before May 15. In addition, the City collects taxes for other entities (Regional District of Nanaimo, School District 68, the Vancouver Island Regional Library, the Municipal Finance Authority and BC Assessment) that have different deadlines and may not have completed the budget and tax requisition processes. For example, the Regional District of Nanaimo has until April 10 to provide the City with tax requisition information.

How do your property taxes make a difference to your community?

Each property tax bill helps pay for the important City services and initiatives that make Nanaimo a community that is livable, environmentally sustainable and full of opportunity for all generations and walks of life. There are two components to the annual property tax increase – a general increase for City operations and a one per cent increase of the annual contribution to the general asset management reserve.

How are my taxes calculated?

The City of Nanaimo determines the tax rate based on what we need to balance the budget for the year. Your tax bill is calculated based on your property’s assessed value, which is determined by BC Assessment and then by the tax rate.

The City also collects taxes for other agencies that offer services in the City including:

- School District

- BC Assessment

- Municipal Finance Authority

- Regional District of Nanaimo (RDN)

- Vancouver Island Regional Library

- Parcel tax for RDN

These agencies determine a tax rate needed for their operations in a similar fashion as the City.

2025 Example:

- Your property is assessed by BC Assessment at $783,800 in Class 1 (residential)

- City of Nanaimo Council approves the Financial Plan and the 2025 Tax Rate based on budget requirements. The municipal tax rate (General and Debt) is set at 3.91081 for every $1,000 in assessment for Class 1

- The municipal levy is calculated as follows:

783,800 / 1,000 = 783.8 x 3.91081 = $3,065.30

For current year property tax rates please visit the Property Tax Information page.

Did you know?

The City has many revenue sources we use to balance the annual budget. One of the sources is property taxation which generally makes up over 50% of the revenue collected. More information on the budget process and revenue sources: City Budget.

How do I appeal my property tax levy?

Each year in May City Council sets the municipal property tax rates for each assessment class. This decision is done after much deliberation during the budget process in the fall in the prior year.

Property owners do not have a mechanism to appeal their property taxes, however, they can appeal their property assessment each year with BC Assessment. The appeal submission deadline is January 31st. More information: BC Assessment - Appeal

What is the Tax year?

Property taxes are levied annually in May for the calendar year (January to December), therefore a portion of the taxes are paid in arrears and a portion in advance.

How do I change the name(s) of the property owners shown on the Tax Notice?

Any changes to the ownership of a property, including name changes, should be filed with Land Titles Survey and Authority.

Victoria Land Title Office

Suite 200 -1321 Blanshard Street

Victoria, BC V8W 9J3

Phone:1-877-577-LTSA (5872) or 604-660-0380

I received a Tax Notice for which I no longer own. What should I do?

Pursuant to the Community Charter a Tax Notice must be delivered to each holder of a registered charge in relation to the property whose name is included in the assessment roll. This means that the City is required to issue a Tax Notice to owners as per BC Assessment's revised assessment roll issued at the end of March each year.

The City endeavours to issue a Tax Notice to new owners between the tax generation day (mid-May) and mid-June.

If you receive a Tax Notice for a property you no longer own you can a) return it to the City or b) forward to the new owner, if possible.

How do I make payment for the property taxes?

Please visit the Property Tax Payment information page.

Last updated: January 23, 2026

Give feedback on accessibility. Submit your feedback through our online accessibility feedback form. Help us understand barriers people face when accessing City services.

You can attach files to help explain the barrier you faced in the form, like: a video, voice recording or photos. If American Sign Language (ASL) is the best way for you to communicate, upload a video of yourself using ASL into the form.

Please include: what you were trying to access, where the barrier happened, what the barrier was and any recommendations you might have.

Help us improve our website

Important Information About Privacy

Information collected on this form is done so under the general authority of the Community Charter and Freedom of Information and Privacy Protection Act (FOIPPA), and is protected in accordance with FOIPPA. Personal information will only be used by authorized staff to fulfill the purpose for which it was originally collected, or for a use consistent with that purpose.

For further information regarding the collection, use, or disclosure of personal information, please contact the Legislative Services Office at 250-755-4405 or at foi@nanaimo.ca

-

Parks, Rec & Culture

- Recreation Facilities & Schedules

- Parks & Trails

- Trails

- Activity Guide

- Events

- Register for a Program

- Drop-In Schedules

- Public Art

- Culture

- Poetry

-

City Services

- Garbage & Recycling

- Home & Property

- Water & Sewage

- Online Services

- Cemetery Services

- City Services Directory

-

Property & Development

- Urban Forestry

-

Building Permits

- Online Building Permit Application

- Building Permit Revision

-

Application for a Residential Building Permit

- Access (driveway) Permit

- Accessory Building Permit

- Alteration Permit

- Building Envelope Repair

- Carriage House

- Demolition Permit

- Fence or Retaining Wall Permit

- Geotechnical Reports

- Locate Permit

- New Construction Permit

- Plumbing or Services Permit

- Secondary Suite Permit

- Special Inspection Permit

- Swimming Pool Permit

- Woodstove Installation Info

- Green Home Initiatives

- Building Three/Four Dwelling Units

-

Apply for a Commercial Building Permit

- Access (driveway) Permit

- Commercial Alteration Permit

- Building Envelope Repair Permit

- Demolition Permit

- Fence or Retaining Wall Permit

- Geotechnical Reports

- Leasehold Improvement

- Locate Permit

- New Commercial Construction Permit

- Occupant Load Permit

- Signs Permit

- Special Inspection Permit

- Sprinkler Requirements

- Fees and Bonding

- Commercial Plumbing Permit

- Certified Professional Program

- Bylaws for Building

- Forms and Guidelines

- Book a Building Inspection

- Report Illegal Construction

- Request Building Plans

- Building Permit Statistics

- Permit Fee Calculator

- Building News and Alerts

- Fast Track Building Permits

- Development Information

- What's Building in my Neighbourhood

- Development Activity Map

- Community Planning

- NanaimoMap

- Rebates

- Engineering Survey

- Land Use Bylaws

- Soil Removal and Depositing

- Heritage Buildings

- Sustainability

- Transportation & Mobility

-

Your Government

- Get Involved

- Government Services Guide

- News & Events

-

City Council

- Advocacy

- Contact Mayor & Council

- Council Meetings

-

Boards & Committees

- Advisory Committee on Accessibility and Inclusiveness

- Board of Variance

- Design Advisory Panel

- Finance and Audit Committee

- Governance and Priorities Committee

- Mayor's Leaders' Table

- Parcel Tax Roll Review Panel

- Special District 68 Sports Field and Recreation Committee

- Public Safety Committee

- Understanding Council Committee Structures

- Council Policies

- Mayor's Office

- Council Initiatives

- Proclamations

- Bastion Lighting Requests

- Alternative Approval Process

- Budget & Finance

- Records, Information & Privacy

- Elections

- Contacts

- Careers

- Maps & Data

- Projects

- Tourism Nanaimo

- Grants

- Awards

- Accessibility & Inclusion

-

Doing Business

- Economic Development

- Doing Business with the City

- Business Licences

- Filming in Nanaimo

- City Owned Property

- Encroachments onto City Property

- Liquor Licences

- Cannabis Retail

- Business Improvement Areas

- Procurement Services

- About Nanaimo

- Green Initiatives

-

Public Safety

- Social Development

- Public Safety Contacts

- Nanaimo Fire Rescue

- Emergency Management

- Police & Crime Prevention

- City Bylaws

- Community Safety and Wellbeing

- Emergency Services